50 REFERENCE LIST Royal Malaysian Customs. The reasons behind that are.

Advantages And Disadvantages Of Gst In Malaysia Financial Aid For College Tax Software Mortgage Interest

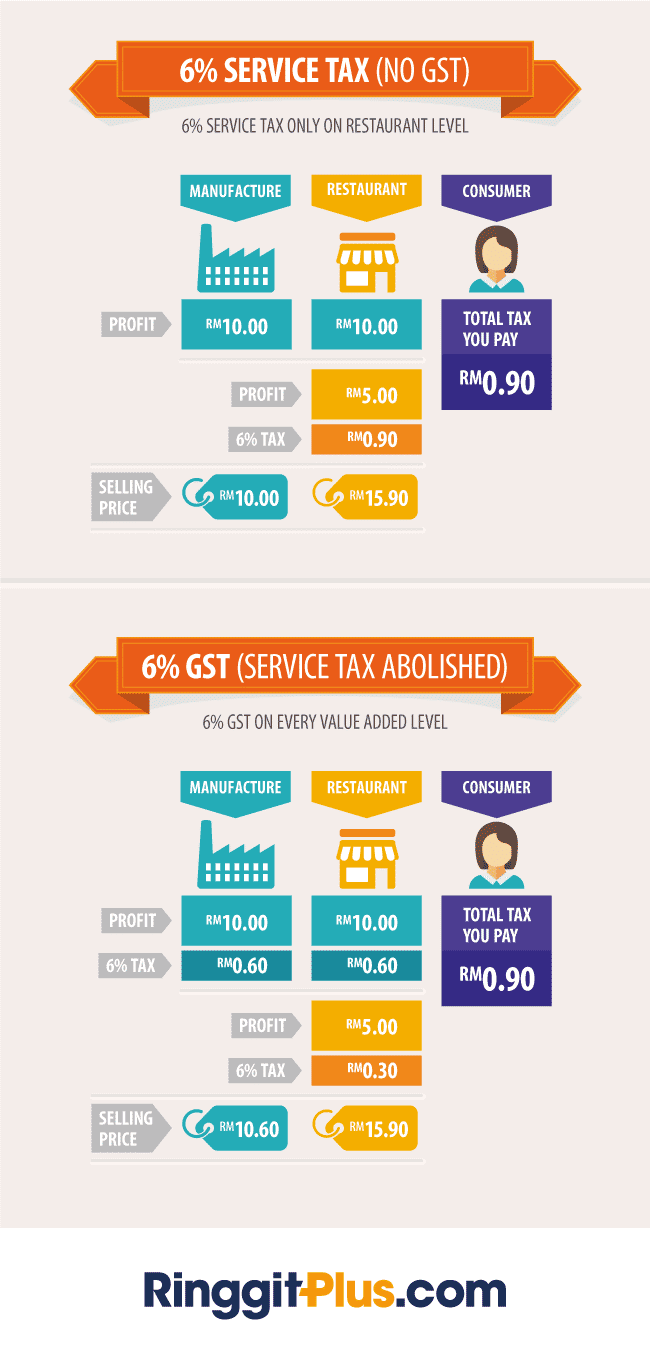

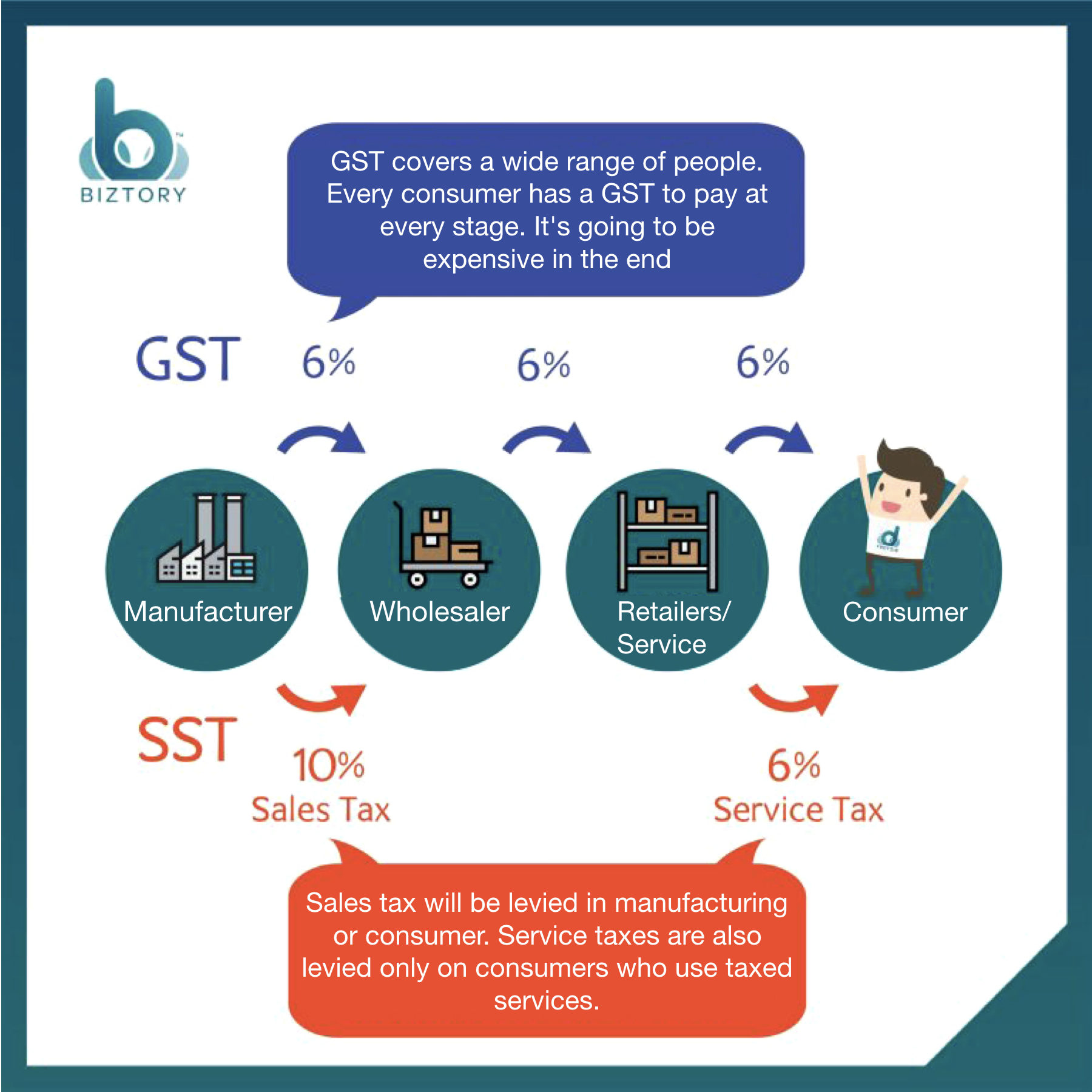

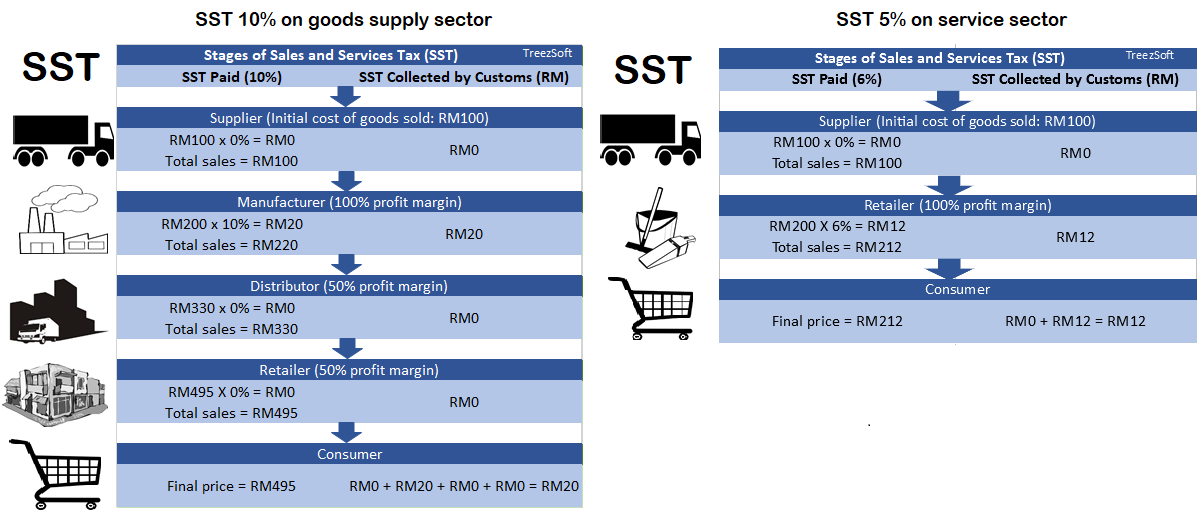

Consumers only pay a 10 factory price unlike the GST multi-stage tax.

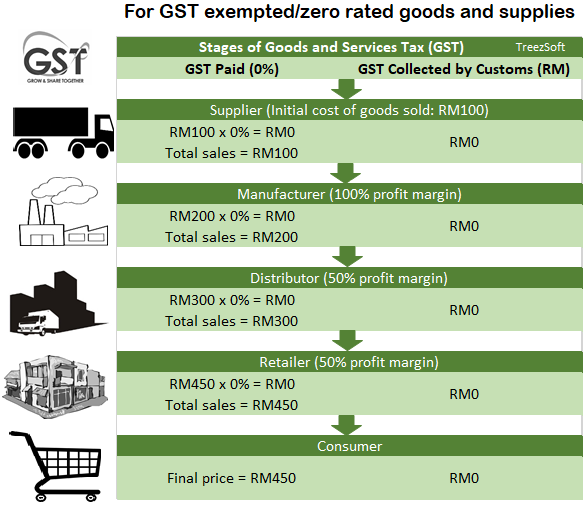

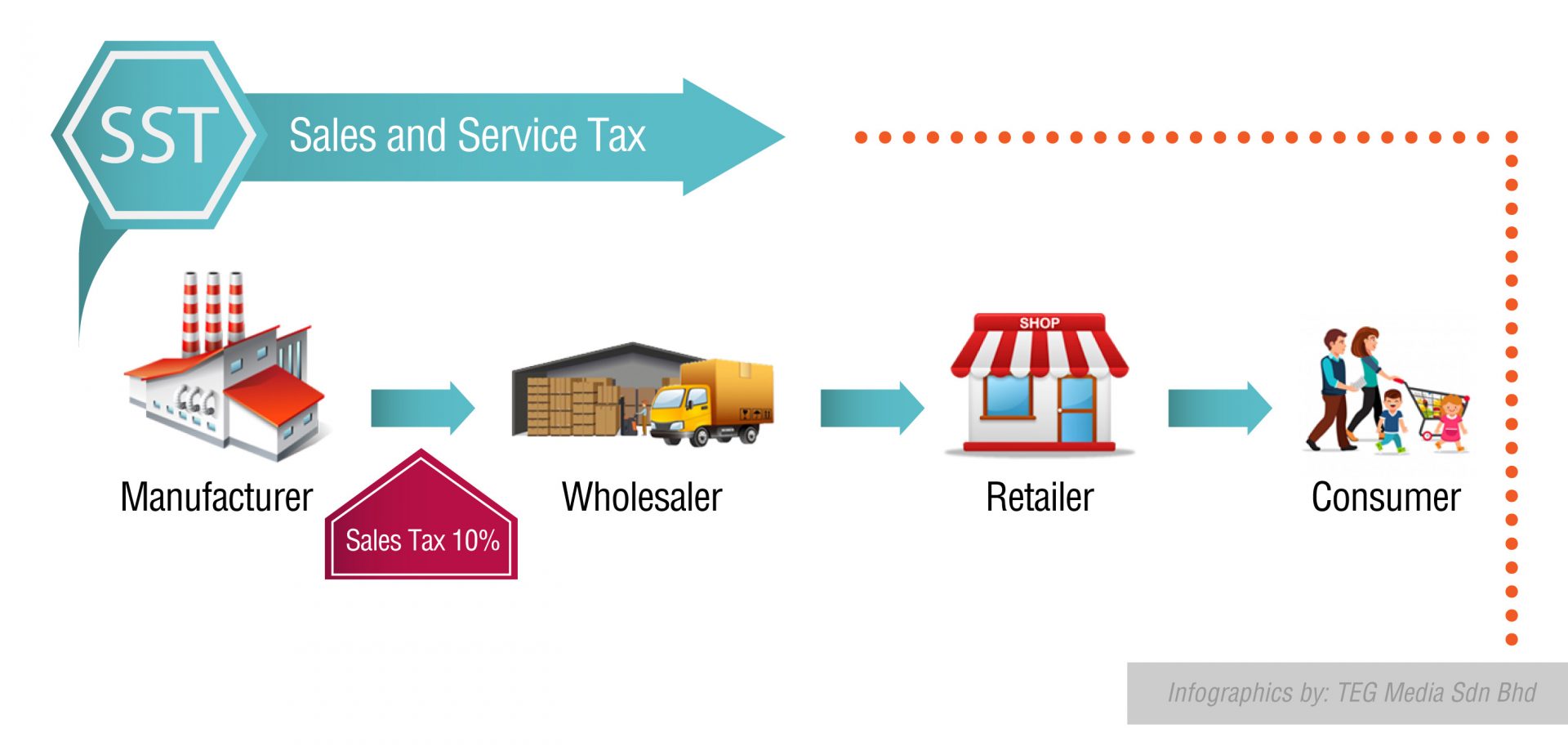

. Therefore the wholesellers and retailers do not need to pay this tax no need to prepare quarterly tax submission as required under. 50 REFERENCE LIST Royal Malaysian Customs. Advantages of Sales and Services Tax Few of the many advantages of sales and services tax Malaysia are- SST is a single stage tax meaning that it is imposed only once during the entire supply chain either at the time of manufactured or at the time imported in Malaysia.

GST in Malaysia has been favorable towards the business people in the country. Malaysia Goods and Services Tax. 5282018 Advantages and Disadvantages of GST in Malaysia Business Setup Worldwide The Goods and Services Tax GST was rst planned to be introduced in the 3 quarter of 2011 by the government of Malaysia.

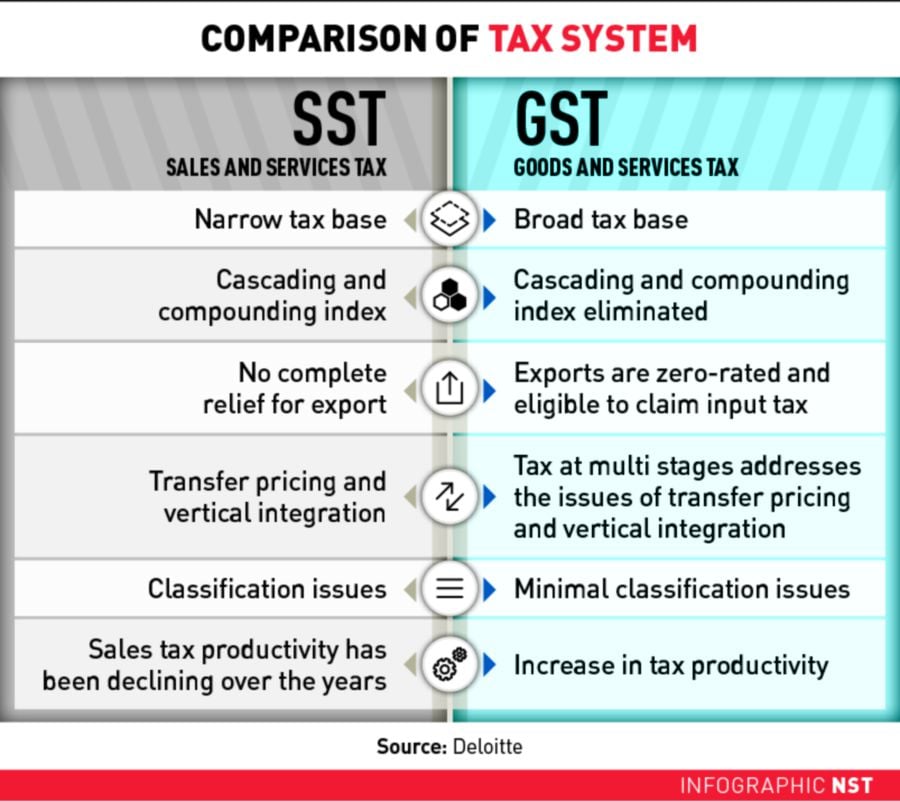

People will think that there is a tax cut of 10. Ultimately a more effective and efficient tax system will help in reducing the fiscal deficit in our country. GST is a unified destination based indirect tax.

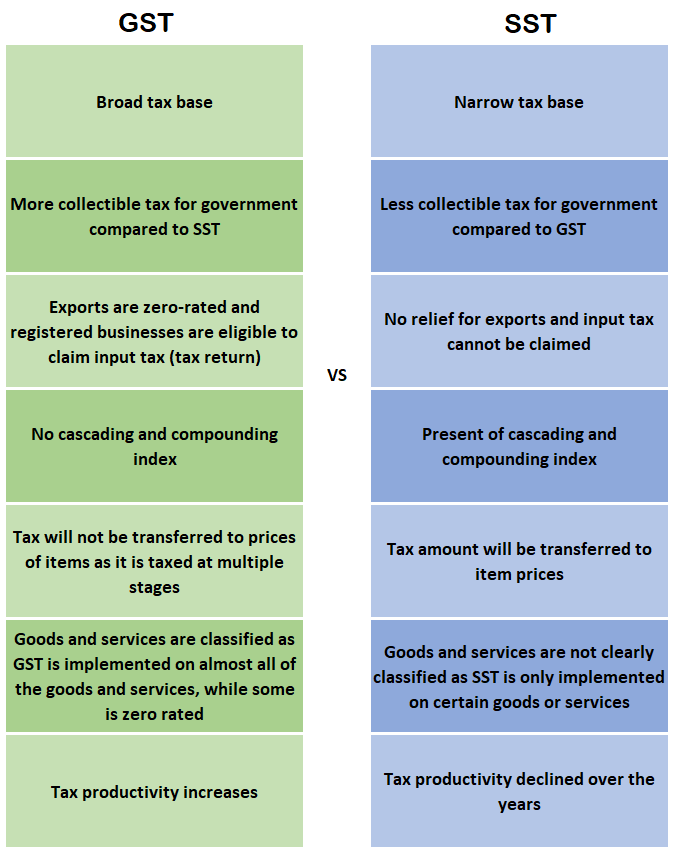

As a conclusion GST should be able to strengthen the Malaysias economy and increase its revenue by expanding the tax base while manage the tax burden of the public as well as help to improve the life quality of Malaysians. First the government has always claimed that 6 of the consumption tax will replace 16 of sales and service tax. MALAYSIAs decision to revert to the Sales and Service Tax SST from the Goods and Services Tax GST will result in a higher disposable income due to relatively lower prices it.

Increased Exemption Limit. As the cost of goods reduces consumption rate increases which benets companies. So if you are planning on setting up a company - servicescompany-formation-services in Malaysia its a fairly lucrative time.

In addition gst could provide fairness and equality as the taxed are levied fairly on the businesses involved such as wholesaling manufacturing service sectors or retailing and provide better transparency to consumers as they will know exactly whether the goods or services they consume are subject to tax and the amount they pay for unlike the. With this benefit the consumer will enjoy to pay the fair price to the goods and services compare when they implement the SST. Advantages of gst in malaysia The Employment Act 1955 Malaysia is the core legislation approved for the welfare and all relevant aspects of employee in Malaysia.

GST malaysia Disadvantages government business consumers The main issues concerning about the implementation of GST is the costs of the goods will increase which will burden the people in the country. Advantages It is a 10 single tax that is imposed on importers or factories. Although the government claim that the implementation of GST will not hurt the businesses and people as the tax paid on the inputs at the.

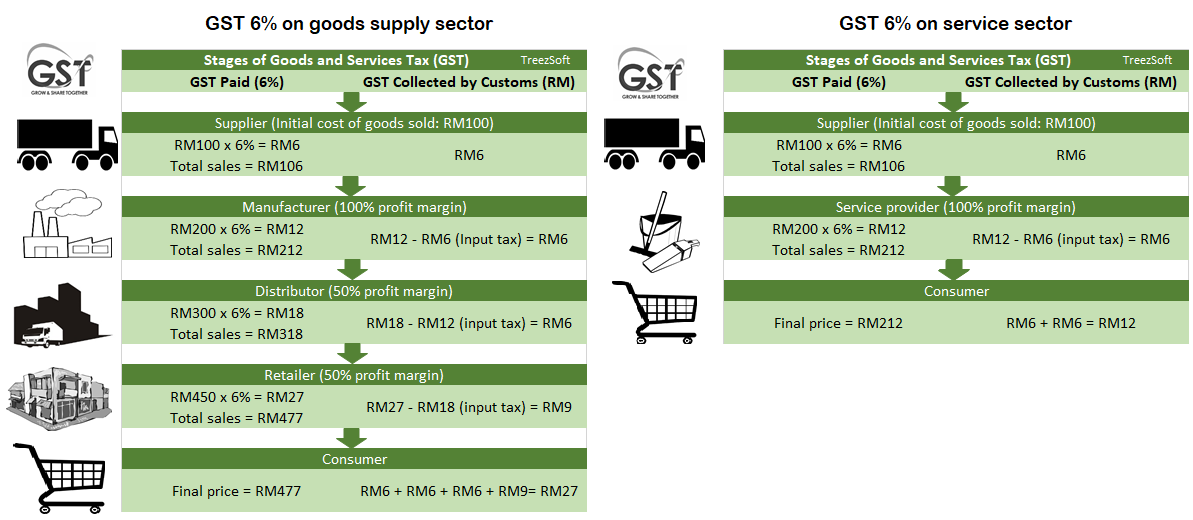

Wholesalers and retailers will not be required to pay the 10 tax which means they will not be required to prepare tax submissions quarterly which is normally required under the GST law. Consequently the Malaysian government could claim more tax income using the. Such a tax is imposed on the value added to goods as well as services at each stage of the supply chain.

Favorable towards Businesses GST in Malaysia has been favorable towards the business people in the country. So if you are planning on setting up a companyin Malaysia its a fairly lucrative time. As the cost of goods reduces consumption rate increases which benefits companies.

1 indirect taxes offer a broader aim because it covers th e whole population unlike direct taxes that merely concentrate on. Answer 1 of 2. Let us emphasize two points again.

GST in Malaysia is an ugly truth. GST is also one of the overall tax reform parts at where it make the taxation system to be more effective efficient transparent business friendly and it will also be capable in generating more stable source of revenue to the country. Registration and Filing Returns.

One of its greatest benefits is the elimination of the possibility of paying double taxes because the two-pronged tax rates and policies in the SST system would have been replaced by one single GST. On paper it sounds like a good. First the GST will provide nearly twice as much tax income as the SST.

Using the earlier juice analogy youll know youre paying RM030 in GST for every RM3 can of juice you buy and nothing else. Disadvantages The Tax Burden on SMEs. The first advantage if the government implement the GST is it can reduce or abolish the double taxation that has been introduced by the current SST.

It is how it. However the fact is that there will be an increase of 2 from 4 to 6. A freelancer earning Rs10 lakh per annum living in Jammu Kashmir Uttarakhand and Himachal Pradesh will be registered under the GST Act.

GST has drawn quite a bit of flak over the years and public opinion is generally that GST has caused prices of goods and services in Malaysia to go up without the country seeing significant benefits to the additional tax revenue collected. Year introduced 1972 1975 Scope Selected items at manufacturing stage and imports Selected taxable services Rate 5 10 specific rate for petroleum 6 specific rate for credit card Advantage Supply of raw materialscomponents are non- taxable - Threshold RM 10000000 Up to RM 3mil CURRENT TAX SYSTEM SALES AND SERVICE TAX 4 5 CURRENT TAX SYSTEM. For businesses GST claim back on tax has been difficult can be declined and requires a minimum of RM500.

It is a single stage tax imposed on factories or importer at 10. The advantages for SST are. Country with the introduction of the GST.

The GST applies to more businesses than the SST.

Gst Better Than Sst Say Experts

Gst Better Than Sst Say Experts

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Pin By Hi Accounts On Accounting Software For Gst Accounting Positive Outlook Accounting Software

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Malaysia Gst Baby Milk Baby Mittens Baby Formula

Sst Vs Gst How Do They Work Expatgo

An Introduction To Malaysian Gst Asean Business News

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Gst Vs Sst In Malaysia Mypf My

Gst Portal Provides Simple To Use Offline Utility For Uploading Invoice Data And Other Records For Creating Gstr 1 Accounting And Finance Worksheets Offline

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Gst Vs Sst In Malaysia Mypf My

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

How Gst Affects Smes From Registration To Daily Operations Benefit Registration

Sst Vs Gst How Do They Work Expatgo